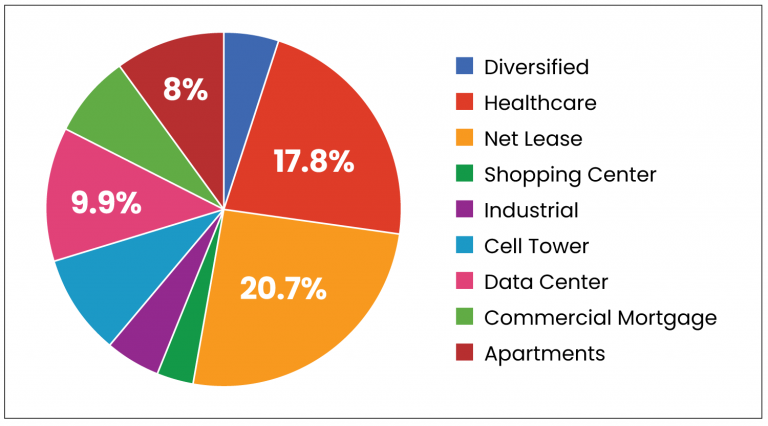

The Durable Income Portfolio is the most conservative and longest REIT strategy for the Intelligent Real Estate Investment Trust (iREIT) research platform, which commenced in 2013. Today the portfolio consists of over 40 REITs and the following property sectors:

This strategy is actively managed with a target hold time of six months to three years. It is designed for “durable income” and thus has overweight positions in Net Lease (20.7%) Healthcare (17.8%), Office (10.4%), Data Centers (9.9%), Cell Towers (7.5%), and Apartments (8.0%).

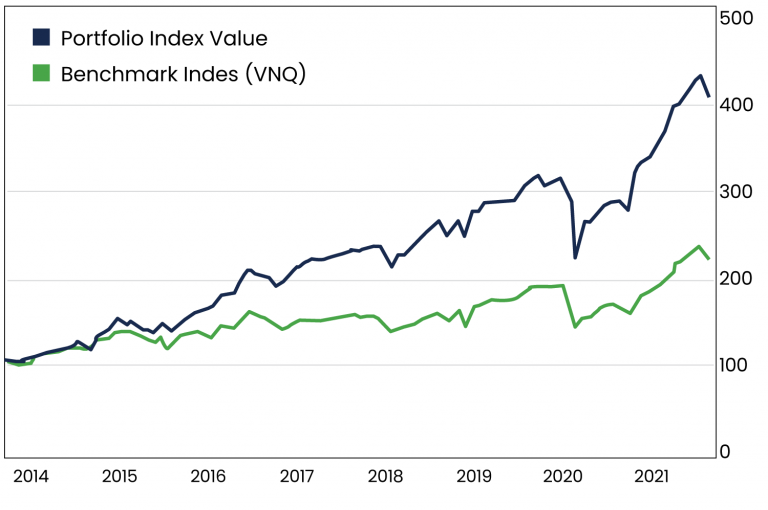

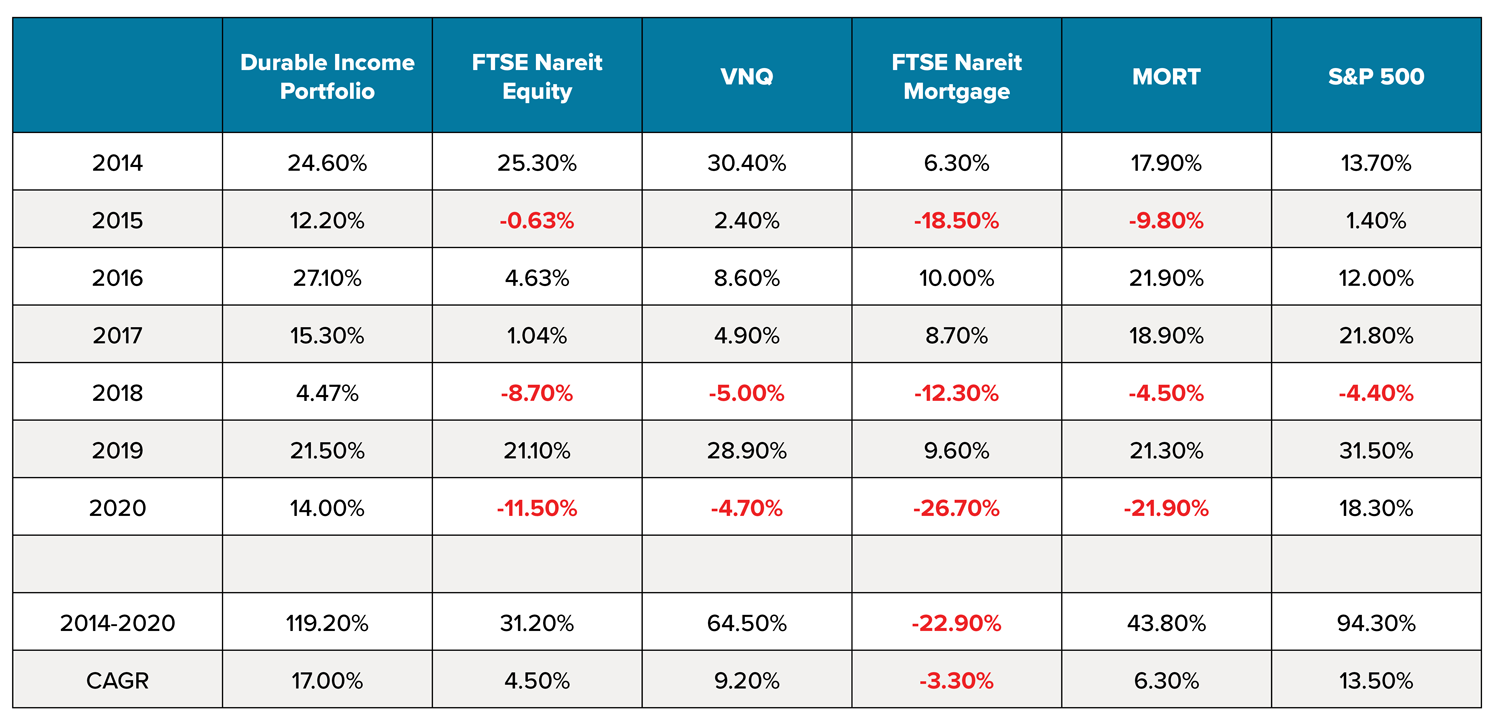

Since inception in August 2013, the Durable Income Portfolio has returned a money weighted compound annual return of 17.0%. It generated positive annual performance in all years since inception. Additionally, only one calendar year failed to generate at least a 12.2% total return. The portfolio’s performance and draw down characteristics were favorable compared to equity and mortgage REIT benchmarks as well as the S&P 500. It has generated consistent and significant alpha throughout its seven-and-a-half-year lifespan and outperformed the CAGR of the VNQ by approximately 700 basis points assuming an 80 basis point annual fee applied to the Durable Income Portfolio. This period includes one large market correction in Q1 of 2020 (-33.9%) and three moderate corrections (10-20% drawdown) occurring in November of 2015, January of 2018, and September of 2018, respectively.

Our current iREIT products were all created in an attempt to share the incredible success of our Durable Income Portfolio with the average investor. If you are looking to receive a return on investment through REITs, check out our iREIT Product page below. You will not be disappointed.

| REIT Mutual Fund | Symbol |

|---|---|

| Alpine Realty Income and Growth Fund | AIGYX, AIAGX |

| American Century Real Estate Fund | REAIX, REACX, AREEX, AREWX, ARYCX, AREDX |

| Real Estate Securities Fund | MRESX |

| AR Capital Real Estate Income Fund | ARIAX, ARICX, ARIPX |

| AssetMark Real Estate Securities Fund | AFREX |

| Aston/Harrison Street Real Estate Fund | AARIX, ARFCX |

| Baron Real Estate Fund | BREIX, BREFX |

| BlackRock Real Estate Securities | BIREX, BAREX, BCREX |

| Brookfield U.S. Listed Real Estate Fund | BRUAX, BRUCX, BRUIX, BRUYX |

| CGM Realty Fund | CGMRX |

| West Loop Realty Fund | REIIX, REIAX, REICX |

| Cohen & Steers Institutional Realty Shares | CSRIX |

| Cohen & Steers Realty Income Fund | CSEIX, CSDIX, CSBIX, CSCIX |

| Cohen & Steers Realty Shares | CSRSX |

| Columbia Real Estate Equity Fund | CREAX, CREIX, CRRVX, CRERX, CREEX, CRRFX, CREWX, CRECX, CREBX |

| Compass EMP REC Enhanced Volatility Weighted Fund | CWRAX, CWRIX, CWRTX, CWRCX |

| Davis Real Estate Fund | RPFRX, DREYX, DRECX, DREBX |

| Delaware Real Estate Investment Trust Portfolio II | DPRTX, DPRBX |

| Delaware Real Estate Investment Trust Portfolio | DPREX, DPRSX, DPRRX, DPRCX |

| DFA Real Estate Securities Portfolio | DFREX |

| Dunham Real Estate Stock Fund | DAREX, DNREX, DCREX |

| DWS RREEF Real Estate Securities Fund | RRRRX, RRREX, RRRAX, RRRSX, RRRBX, RRRCX |

| DWS RREEF Real Estate Securities Income Fund | REFAX, REFCX, REFIX, REFSX |

| Eaton Vance Real Estate Fund | EAREX, EIREX |

| EII Realty Securities Fund | EIIRX |

| Fidelity Advisor Real Estate Fund | FHEIX, FHEAX, FHETX, FHECX, FHEBX |

| Fidelity Advisor Real Estate Income Fund | FRIRX, FRIQX, FRINX, FRIOX |

| Fidelity Real Estate Income Fund | FRIFX |

| Fidelity Real Estate Investment Portfolio | FRESX |

| Fidelity Spartan Real Estate Index Fund | FSRNX, FRXIX, FSRVX |

| Fidelity Series Real Estate Equity Fund | FREDX, FREFX |

| Fidelity Series Real Estate Income Fund | FSREX, FSRWX |

| Forward Real Estate Long/Short Fund | KSRYX, FRLSX, FFSRX, KSRAX, KSRCX, KSRBX |

| Forward Real Estate Fund | FPREX, FFREX, KREAX, KRECX |

| Forward Select Income Fund | KIFYX, FSIMX, FFSLX, KIFAX, KIFBX, KIFCX |

| Franklin Real Estate Securities Fund | FREEX, FRLAX, FRRSX, FSERX |

| GMO Real Estate Fund | GMORX |

| Goldman Sachs Real Estate Securities Fund | GREIX, GRETX, GREAX, GRESX, GRERX, GREBX, GRECX |

| Great-West Real Estate Fund | MXREX |

| Heitman REIT Fund | OARTX, OBRTX |

| ING Real Estate Fund | CRARX, IREWX, IDROX, CLARX, CRWRX, CRCRX, CRBCX |

| INVESCO Real Estate Fund | REINX, IARFX, IARIX, IARYX, IARAX, IARRX, IARCX, AARBX |

| Ivy Real Estate Securities Fund | IRSAX, IREIX, IRSYX, IRSRX, IREEX, IRSCX, IRSBX |

| John Hancock Real Estate Securities Fund | JIREX |

| Johnson Realty Fund | JRLTX |

| J.P.Morgan Realty Income Fund | URTLX, JRIRX, URTAX, URTBX, URTCX |

| J.P. Morgan Security Capital U.S. Core Real Estate Securities Fund | CEEAX, CEERX, CEEFX, CEESX, CEECX |

| J.P. Morgan U.S. Real Estate Fund | SUSIX |

| Lazard U.S. Realty Equity Portfolio | LREIX, LREOX |

| Lazard U.S. Realty Income Portfolio | LRIIX, LRIOX |

| Manning & Napier Real Estate Series | MNRIX, MNREX |

| Morgan Stanley Institutional U.S. Real Estate Portfolio | MSUSX, MUSDX, MSULX, MURSX |

| Natixis AEW Real Estate Fund | NRFAX, NRFYX, NRFBX, NRFCX, NRFNX |

| Neuberger Berman Real Estate Fund | NBRIX, NBRFX, NREAX, NRERX, NRECX, NRREX |

| Nuveen Real Estate Securities Fund | FREAX, FARCX, FRSSX, FREBX, FRLCX, FREGX |

| Oppenheimer Real Estate Fund | OREAX, OREIX, OREYX, ORENX, OREBX, ORECX |

| PHOCAS Real Estate Fund | PHREX |

| PIMCO RealEstateRealReturn Strategy Fund | PRRSX, PETPX, PETAX, PETDX, PETCX, PETBX |

| Pioneer Real Estate Shares | PWREX, PYREX, PCREX, PBREX |

| Principal Real Estate Securities Fund | PIREX, PIRPX, PREPX, PRETX, PREJX, PRRAX, PRERX, PRENX, PRAEX, PRCEX, PRLEX |

| ProFunds Real Estate UltraSector ProFund | REPIX |

| Prudential Select Real Estate Fund | SREAX |

| Prudential U.S. Real Estate Fund | PJEAX, PJEZX, PJECX, PJEBX |

| REMS Real Estate Income 50/50 Portfolio | RREIX |

| REMS Real Estate Value-Opportunity Fund | HLRRX, HLPPX |

| Rydex Real Estate Fund | RYREX, RYHRX, RYCRX |

| SA Real Estate Securities Fund | SAREX |

| SEI Institutional Mgd Real Estate Fund | SETAX, SEIRX |

| Spirit of America Real Estate Income & Growth Fund | SOAAX |

| SSgA Clarion Real Estate Fund | SSREX |

| Stratton Real Estate Fund | STMDX |

| T.Rowe Price Real Estate Fund | TRREX, PAREX |

| TIAA-CREF Real Estate Securities Fund | TIREX, TRRPX, TRRSX, TCREX |

| Vanguard REIT Index Fund | VGSNX, VGRSX, VGSLX, VGSIX |

| Virtus Real Estate Securities Fund | PHRAX, PHRIX, PHRCX, PHRBX |

Source: NAREIT

| REIT ETF | Symbol |

|---|---|

| Flex Shares | ASET |

| Wisdom Tree Global Ex-US | DRW |

| S&P 500 Equal Weight | EWRE |

| iShares FTSE Industrial/Office | FNIO |

| MSCI Real Estate Index | FREL |

| S&P REIT Index | FRI |

| First Trust S&P REIT | FRI |

| iShares Real Estate 50 | FTY |

| Flexshares Global | GQRE |

| iShares Cohen & Streers | ICF |

| iShares International Developed RE | IFGL |

| iShares US RE | IYR |

| Premium Yield Equity REIT | KBWY |

| ETRACS Monthly Pay 2x Leverage | MORL |

| Market Vector Mortgage | MORT |

| iShares Global REIT | REET |

| iShares FTSE Mortgage | REM |

| iShares Residential | REZ |

| IQ US Real Estate Small Cap | ROOF |

| iShares FTSE NAREIT Retail | RTL |

| DOW Jones Global RE | RWO |

| SPDR Dow Jones | RWR |

| Schwab US REIT | SCHH |

| Super Dividend REIT | SRET |

| ProShares Ultra RE | URE |

| Vanguard REIT | VNQ |

| Vanguard Global ex-US | VNQI |

| iShares International Developed | WPS |

| Wilshire US REIT | WREI |

| Pacer Benchmark Data & Infrastructure RE | SRVR |

| Pacer Benchmark Industrial RE | INDS |

| Pacer Benchmark Retail RE | RTL |

| Hoya Capital Housing | HOMZ |

| NetLease Corporate RE | NETL |

| REIT Name | Ticker | Annual Increases/yr |

|---|---|---|

| Federal Realty | FRT | 51 |

| Universal Health Realty | UHT | 33 |

| National Retail Properties | NNN | 29 |

| Realty Income | O | 27 |

| Tanger Outlets | SKT | 26 |

| Urstadt Biddle | UBA | 25 |

| Essex Property Trust | ESS | 25 |

| W.P.Carey | WPC | 22 |

| National Health Investors | NHI | 17 |

| Equity Lifestyle | ELS | 15 |

| Digital Realty | DLR | 15 |

Source: www.dripinvesting.org